The smart Trick of Lighthouse Wealth Management, A Division Of Ia Private Wealth That Nobody is Discussing

Wiki Article

9 Easy Facts About Lighthouse Wealth Management, A Division Of Ia Private Wealth Described

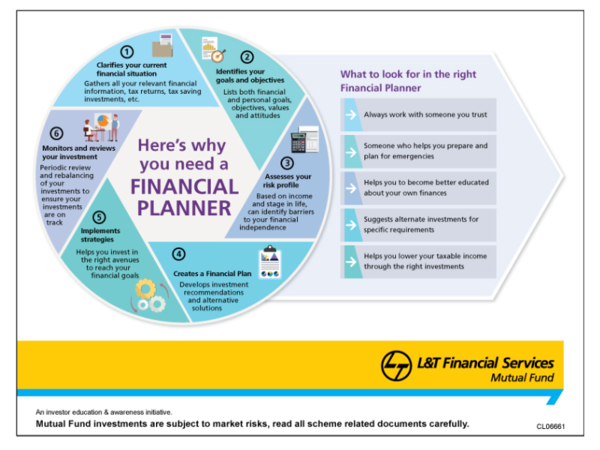

These are all things your monetary consultant can take on. Most advisors meet with their clients to talk about investment opportunities.

That might include discussions around estate preparation, insurance, social safety and security, and much more. All you need to do is ask as several inquiries as possible during these conferences.

In contrast to popular idea, monetary planning is not a one-size-fits-all procedure. Saving is just one item of the economic planning puzzle.

Often, conserving can be your finest option, however other times, your solution might be spending (retirement planning copyright). It's up to your monetary expert to help you choose on the very best technique depending on your requirements. Employ an economic consultant for a method that'll aid meet your financial goals. There are countless financial investment opportunities.

The Best Guide To Lighthouse Wealth Management, A Division Of Ia Private Wealth

Creating properly diverse profiles calls for a considerable quantity of time and experience. So, it 'd be best if you were to employ a monetary expert to assist you instead of go at it by yourself. It's much more meaningful for you to ensure your economic advisor is a you can look here fiduciary - https://forums.hostsearch.com/member.php?251863-lighthousewm. [Put link to the RIA distinction web page] This will provide you peace of mind knowing that suggestions and assistance are based only on your benefits and out the what would certainly be a lot more financially rewarding for your advisor.

Have you determined to hire a monetary expert? A financial consultant will certainly aid with financial planning, investment choices, and riches monitoring.

You are regarding to pick among the fastest-growing career choices in India. As the country grows at a fast lane and develops a big center course and HNI populace, there is an expanding need for Financial Advisors. Nonetheless, this continues to be a highly competitive career option where only the best in profession rise up the pyramid.

These characteristics or elements will decide your success in the future. Numerous attributes or components divide the very best Economic Advisors from the regular or bad ones in the marketplace. If you desire to be effective in this occupation you require to have these traits. Not every person that selects to be a Monetary Advisor is birthed with these qualities, yet you can conveniently imbibe these characteristics and create your name in this occupation.

Our Lighthouse Wealth Management, A Division Of Ia Private Wealth Statements

The very first and one of the most vital high quality of a Monetary Advisor is a ruthless enthusiasm for financing and the job. This isn't a regular job however one that would test your logical capacity every day. You 'd be assisted by heaps of data and loads of tools, you will require to use your expertise in financing and use that in special ways to get wanted results for your customers.

Hence, you should have an interest for money and always stay ahead in the game. The regulations, regulations, and conformity requirements concerning investment, preparation, and finance keep changing on a regular basis and you have to stay abreast with them. For example, a tiny adjustment in taxes regulations can influence your customers' long-lasting investment planning or raise their tax obligation responsibility and you have to have a detailed understanding of how these laws would impact your clients and be able to suggest the best kind of shift in strategy to take advantage of these modifications and not end up being a sufferer of it.

There need to be no uncertainty in your judgment and your lack of knowledge or out-of-date understanding must not come back to harm your clients. In simple words, you have to have fire in your stomach and without it, you 'd never do well in this race - private wealth management copyright. Investments, tax planning, retirement planning is a vibrant field

The most effective approaches employed a few years back could not be the most effective for today and the future. Hence, a Financial Advisor needs to have their hands on the pulse of the market and recommend the right investment and retirement options to their clients (https://hearthis.at/carlos-pryce/set/lighthouse-wealth-management-a-division-of-ia-private-wealth/). It asks for an excellent Financial Advisor to be intellectually interested and you need to regularly search for the most up to date patterns and approaches in the marketplace

How Lighthouse Wealth Management, A Division Of Ia Private Wealth can Save You Time, Stress, and Money.

You should be a lifelong learner and never ever rest over the laurels of the past. It is essential to be on a course of self-improvement and learning from past errors. You won't call it ideal every single time and with every client but you should constantly collect new understanding that allows you help the bulk of your customers fulfill their financial objectives.

Every customer is various includes various collections of monetary objectives, danger hunger, and has different perspectives for financial investment. Not all clients are terrific communicators and you should put your curiosity to great use and comprehend their goals. Discovering the one-of-a-kind requirements of a client and suggesting the ideal choices is among one of the most essential qualities in this occupation.

Report this wiki page